Military Apr Limit - We believe that everyone should be able to make financial decisions with confidence. Our site does not represent every company or financial product on the market, but we are proud of the fact that the guidance we offer, the information we provide and the tools we create are objective, independent, clear and free.

[7] A financing overdraft is a covered consumer credit product if: it is offered to a secured borrower; the loan provided by the lender is mainly intended for personal, family and household needs; the Asset Account is overdrawn and used to pay any fees or charges payable by the Covered Borrower;

Military Apr Limit

and previously agreed in writing to extend the credit period and charge for the goods. Many or all of the products listed here are from our compensating partners. This affects which products we write about and where and how these products are displayed on the page.

Know All Your Legal Rights And Benefits

However, this does not affect our rating. Our opinions are our own. Here is a list of our partners and how we make money. Comment: § 232.5 (opens in new window) (You will leave NCUA.gov and visit a non-NCUA website. We encourage you to read NCUA's exit linking policy. (opens new page).) There is no time limit or recordkeeping required when

one of the secure ports is used for authentication. However, the credit union will evaluate the method it chooses to determine whether it is reasonable and verifiable, and whether it poses a risk of making consumer loans that do not comply with the law.

Disclaimer: NerdWallet strives to keep its information accurate and up-to-date. This information may differ from the information you see when you visit a financial institution, service provider or specific product website. All financial products, trading products and services are offered without warranty.

Source: qph.fs.quoracdn.net

Check the financial institution's terms and conditions when evaluating the offer. Pre-qualified offers are non-binding. If you have a discrepancy with your credit score or credit report information, please contact TransUnion® directly. DoD Regulations, 32 CFR Part 232 (opens in new window) (You will leave NCUA.gov and visit a non-NCUA website. We encourage you to read NCUA's exit link policy. (opens new page).) , MLA ) contains certain

restrictions and requirements on consumer loans to active employees and their spouses, children and certain other dependents ("protected borrowers"). With certain exceptions, the provisions apply both to persons engaged in the business of lending that meet the definition of creditor in Regulation Z, as well as to their assignees.

For secured transactions, limits are set by the lender, including interest rates, fees, charges, and other credit-related products sold in connection with the transaction, such as credit insurance, cancellation, or cancellation of debt. The total premium, expressed as an annual interest rate known as the Military Annual Percentage Rate (MAPR) [1], cannot exceed 36 percent.

[2] MAPR includes finance charges or fees not included in the annual percentage rate (APR) disclosed under the Integrity in Lending Act (TILA). [3] Previously, the MLA rules only applied to certain types of loans, such as: well-defined payday loans, car loans and tax refund loans with certain conditions.

The current rule provides a broader definition of “consumer credit” within the scope of the statute that is generally similar to the definition in Regulation Z. Some examples of additional credit products subject to statutory protection for protected borrowers: Note that these benefits generally apply to previously opened cards

![Chase Military Credit Card Perks: How Service Members Can Save [2023] | Financebuzz](https://images.financebuzz.com/1455x768/filters:quality(70)/images/2020/07/23/service-member-holding-son.jpeg) Source: images.financebuzz.com

Source: images.financebuzz.com

, not during active military service. If you're already in service and thinking about opening a new account, call the issuer first to see if there are any discounts available. A credit agreement that violates the PIA is void from the outset.

For most products, lenders must comply with the DoD's July 2015 rule by October 3, 2016. For credit card accounts, lenders do not have to comply until October 3, 2017. [8] Interest payments on certain federal student loans incurred after September 30, 2008 are waived

military personnel and veterans who served in areas subject to threat or hostile fire. All banks offer financial incentives to their active members, but some offer much more than required by law. The federal Servicemembers Civil Relief Act, or SCRA, requires lenders to, among other things, cap the interest rate on advance loans at 6% and waive servicing and renewal fees such as annual fees, foreign transaction fees and late fees.

But several major issuers offer lower rates on both existing credit card balances and new purchases, sometimes extending the low rate for up to a year after a service member leaves active duty. If you're trying to improve your credit score and are having trouble qualifying for the no-fee option, take advantage of SCRA benefits to waive the annual fee.

Paying off your balance on time and taking out a smaller loan can help you get better terms in the future. [1] MAPR is calculated in accordance with 32 CFR §232.4(c). (opens in new window) (You will leave NCUA.gov and enter a non-NCUA website. We encourage you to read NCUA's Exit Link Policy. (opens new page).) Be smart and get what you deserve.

Source: static.timesofisrael.com

Source: static.timesofisrael.com

Get all the legal benefits of being a service member, veteran or spouse, and get updates delivered straight to your inbox by signing up for Military.com. If so, the loan is a purchase to build or refinance home loan;

reverse mortgage; or a home loan or credit? If this is the case, the agreement does not apply to housing loan transactions, regardless of whether the borrower lives in the apartment. You can find the full implementation procedure here (opens in new window) (You will be leaving NCUA.gov and visiting a non-NCUA website. We encourage you to read NCUA's exit link policy. (opens new page).) .

For many active members, the promise of 0% to 40% and waived fees may sound like just another Veterans Day sale, but it's a good deal available in the short term. But some credit card companies are changing that, quietly offering such perks to service workers year-round.

For those paying off debt, interest relief can add up to hundreds of dollars in savings. If a court determines that military service does not "substantially affect" the service member's ability to repay the debt, the issuer may choose not to provide these extended terms.

In other words, if the creditor is a highly paid service member and has no problem paying higher fees, a court order can be issued allowing the service member to charge flat rates and fees. But in reality, major credit card issuers don't.

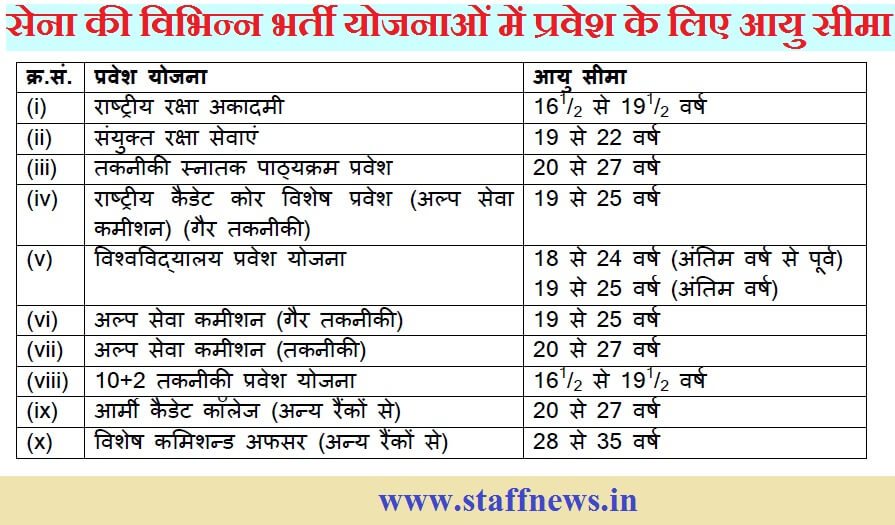

Source: www.staffnews.in

Source: www.staffnews.in

You must have made purchases or paid off your debt prior to enrollment, and most loans are capped at 6% interest throughout the service. The mortgage interest will be capped at 6% and valid for one year after discharge.

[4] The Federal Credit Union Act prohibits credit unions from imposing prepayment penalties on all loans under federal law (12 U.S.C. 1757(5)). (opens in new window) (You will leave NCUA.gov and enter a non-NCUA website. We encourage you to read NCUA's Exit Link Policy. (opens new page).) [8] To extend compliance cards, accounts must be

on an open (unsecured) consumer credit plan. The limited exemption period for credit card accounts may, by order of the Ministry of Health, be extended by 3 October 2018. For all other loan products, lenders must meet the relevant requirements of the July 2015 regulations by October at the latest.

March 3, 2016 for all consumer credit transactions or accounts made or opened on or after October 3, 2016. From low interest rates to military customer service experts, having a credit card from a bank that offers excellent military benefits can pay off big.

Be sure to notify your service provider if you are preparing for deployment or are already serving overseas. They can be more useful than you think. If you have excellent credit and never carry a balance, you can get more value from cards with premium features like higher rewards, airline fee credits, waived baggage fees, airport lounges and free upgrades.

Source: www.cardrates.com

Source: www.cardrates.com

If you get your card before starting active work, you do not have to pay the annual fee for the entire service. So how do we make money? Partners compensate us. This may affect which products we review and write about (and where these products appear on the site), but in no way affects our recommendations and advice, which are based on thousands of hours of research.

Our partners cannot pay us to ensure positive reviews of their products or services. Here is a list of our partners. Military Loan Act (MLA), 10 U.S.C. § 987. is administered by the Department of Defense and protects active military personnel, their spouses and their dependents from certain credit activities.

Even if you don't fall into one of these categories, your bank can help you. Capital 1 also extends coverage to other active duty service members not covered by the law, including National Guard members called to publicly funded service, a spokeswoman said.

USAA benefits military members who are deployed, frequently changing stations (PCS), or serving in qualifying military campaigns regardless of SCRA status. Many issuers offer benefits to actual military spouses, whether or not they have a joint account with the military member.

If you're not sure if you qualify, check with your issuer. In 2013, parliamentary amendments to the Act empowered the authorities to comply with the requirements of Section 108 of the Swedish Parliament Act. [5] These agencies include the Board of the Federal Reserve System, the Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corporation, the National Credit Union Administration, the Office of the Comptroller of the Currency, and the Federal Trade Department.

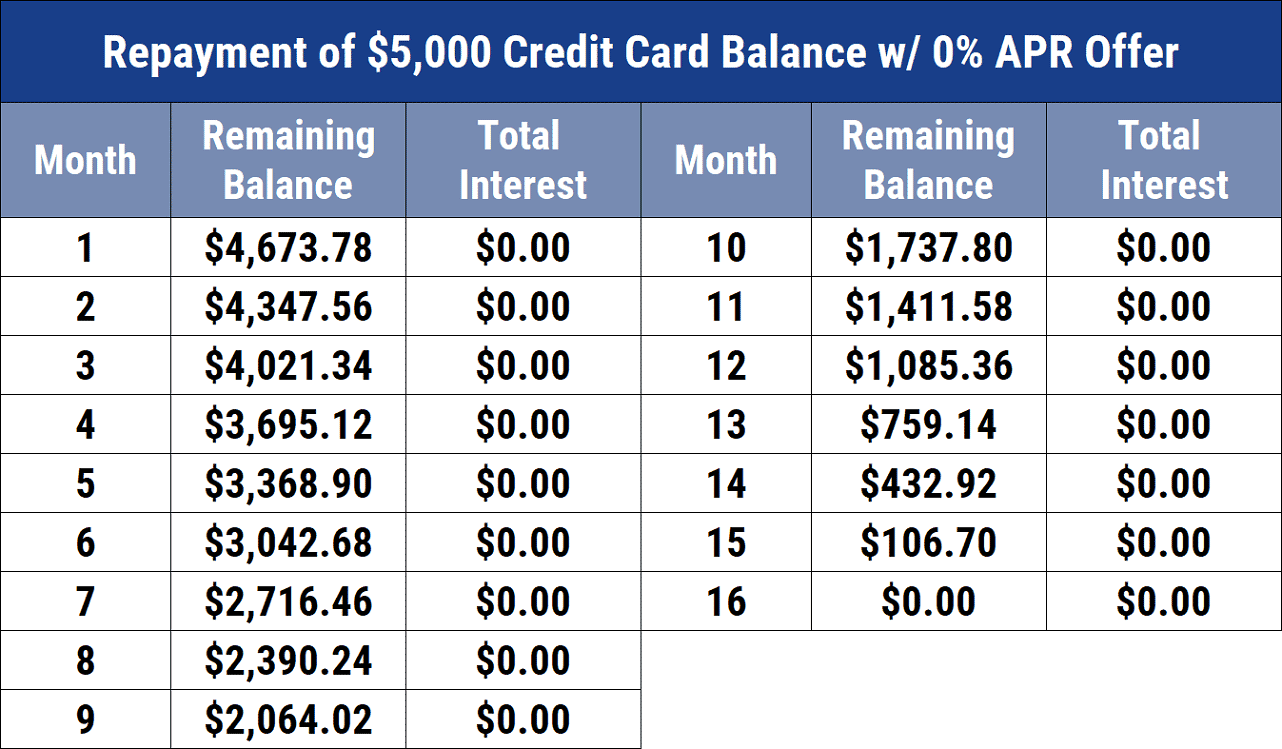

Commission. State regulators also exercise oversight over public agencies as required by the MLA, pursuant to powers under state law. SCRA benefits can make your total balance more affordable, especially if your issuer offers 0% APR for active members.

If you pay the equivalent of a high balance, these savings can add up quickly. Remember, the balance transfer fee of 3% or 4% of the balance transferred is waived for SCRA-eligible accounts. By transferring your balance to your 0% APR card, you can save on interest and fees.

You can access the full House text here (opens in new window) (You will be leaving NCUA.gov and visiting a non-NCUA website. We encourage you to read NCUA's Exit Link Policy. (opens new page).) .

military apr rate, military apr calculator, military apr law, apr army, military apr regulation, military apr calculator tool, military apr cap

0 Comments